Led by International Tax Consultant Jack Brister, the IWTA team excel at solving complex cross border tax issues. Working with clients’ offshore and domestic wealth structures and investment portfolios, we strategically pinpoint the intricacies and weaknesses of U.S. and foreign tax systems to minimize loss of wealth and profits.

Founded in 2015 and located in the heart of New York City on Avenue of the Americas, International Wealth Tax Advisors provides highly personalized, secure and private global tax accounting and consulting to individuals, families, family offices and foreign-based multinational business clients across the U.S.A and North America, Europe, South America, Asia, Africa, Australia and the Middle East.

SERVICES

Our Specialties

Foreign Trust, Estate and Gift Taxation

Based on clients’ jurisdiction and current needs, IWTA provides strategic consulting and assists in selecting and implementing a wealth transfer structure to maximize returns and minimize tax exposure.

Pre-Immigration and Expatriation Planning

IWTA assists clients planning to become U.S. taxpayers as well as those terminating their citizen or green card status. We help mitigate the substantial taxes that can result from these decisions.

U.S., Real Estate & Foreign Investments

IWTA provides non-U.S. taxpayers diligent assessment of and planning for investments in U.S. business and real estate. For U.S. taxpayers: We provide foreign investment and tax strategies.

Foreign Financial Asset and FBAR Reporting

Get help with FACTA, foreign financial asset reporting and the FBAR and know the filing requirements: Most U.S. persons with interest in foreign accounts/investments are required to report, and to file the FBAR.

Voluntary Disclosures

The U.S. federal and state governments have long-standing offerings of voluntary disclosure programs. IWTA helps taxpayers who have lapsed in tax filing and international disclosures get back in compliance.

Business Activities

IWTA helps clients establish businesses in the USA, structure them for maximum tax benefits, and file tax returns as U.S. policies and regulations dictate. Knowing and complying with U.S. State and Local tax laws are critical factors.

Foreign Account Tax Compliance Act (FATCA)

IWTA helps clients find the right classification for their entities, obtain a Global International Identification Number, and prepare Form W-8 and Form 8966 to ensure compliance.

Non-Resident Alien Tax Planning

The time NRAs spend in the U.S., combined with U.S. investment structure is critical to minimize U.S. tax exposure and liability. IWTA helps NRAs avoid costly mistakes with a personalized strategic financial and tax plan.

Twitter Feed

Breaking #internationaltax News

The U.S. is the world's largest economy with vast opportunities to expand wealth.

The “American Dream” of building unlimited wealth through investments in the U.S.A is practically a global obsession. However, understanding the U.S. system of worldwide tax collection and what legally defines an entity as a U.S. taxpayer is critical to building, growing and keeping your investments.

IWTA’s Guiding Values:

We are guided by these values and pledge our commitments in service to our clients.

Integrity

Authenticity

Tenacity

Security and Confidentiality

Add Substantive Value in all we Do

KNOWLEDGEABLE

Get Up to Date Information

IRS: Partial Penalty Relief Still Available for 2019 and 2020 Returns, But it Depends…

Amidst the upheaval of the COVID-19 pandemic, some U.S. taxpayers were unable to file their 2019 or 2020 income tax returns within the IRS’ filing deadlines The Internal Revenue Service, in a show of understanding, fully waived penalties for individual taxpayers and businesses who filed certain late returns by September 30, 2022. Although the deadline has recently passed — and the IRS is not extending it — taxpayers who file late 2019 or 2020 returns may nonetheless be eligible for partial penalty relief, according to the IRS. Provisional grace also applies to taxpayers filing certain international information returns, including Form 3520, Annual Return To Report Transactions With Foreign Trusts and Receipt of Certain Foreign Gifts; Form 3520-A, Annual Information Return of Foreign Trust With a U.S. Owner (Under section 6048(b)). Read more…

IRS New JSEIT Unit Will Use Crowdsourcing, Cooperative Intra-Agency Intelligence and Media Alerts to Quash Emerging Tax Fraud Schemes

Announced in June, the Joint Strategic Emerging Issues Team, or JSEIT, combines expertise from units across the agency, including Criminal Investigation, Tax Exempt/Government Entities, Large Business & International, and Small Business/ Self Employed.

JSEIT’s goal is to act before a tax scheme becomes a widespread issue. Acting as a conduit between taxpayers with compliance issues and the relevant IRS division, JSEIT hopes to provide early communication to prevent abusive fraud. Any transactions that have already been identified as abusive by the IRS will not be in focus.

Jack Brister Featured in Live Event: Estate Planning and Investment Strategies for Multi-Nationals on Oct. 25, 2022

IWTA Founder Jack Brister Featured in Live Event:

Estate Planning and Investment Strategies for Multi-Nationals

New York City, Oct. 25, 2022

Complex Tax and Non-Tax Issues to Be Covered in Depth at Event Produced by European American Chamber of Commerce (EACCNY) on Oct. 25, 2022, 8:30-10:30 a.m. Trust and estate planning and investment strategies for multinationals is a complex topic about which International Wealth Tax Advisors founder Jack Brister has encyclopedic knowledge.

An update on the tax rules and strategies multi-nationals must follow in these areas is the topic of a live event at which IWTA Founder Jack Brister is participating on Tuesday, Oct. 25, 2022. The free event, produced by the European American Chamber of Commerce (EACCNY) takes place from 8:30 to 10:30 a.m. at the New York City headquarters of Offit Kurman.

Frozen: How the Revocation of the U.S. – Russia Tax Treaty Puts Global Trade on Thin Ice

This blog post is an update to IWTA founder Jack Brister’s article published in JD Supra on March 18, 2022, entitled, “Frozen: How the Revocation of the U.S. – Russia Tax Treaty Puts Global Trade on Thin Ice.” The Biden administration is poised to fully block Russia’s ability to pay U.S. bondholders. The Treasury Department told multiple news outlets that it had suspended its tax information exchanges with Russia. Read more…

It Happened in South Dakota

The Pandora Papers, a recent reveal of pervasive cross-border financial crime and elaborately-crafted tax dodging structures, as reported by a global network of investigative journalists, has

already shaken up governments and elections, upended tax authorities and initiated criminal investigations… Perhaps the most intriguing revelation of all from a stateside perspective was the emergence of South Dakota as a preferred tax haven of the rich and famous.

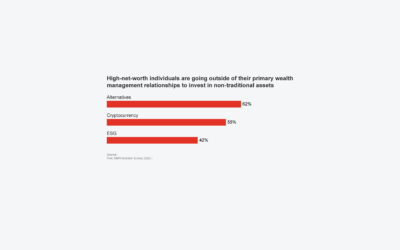

High-Net-Worth Individuals Look to Expand Their Investments

Jack Brister Founder, International Wealth Tax Advisors Jack Brister, Founder of International Wealth Tax Advisors, is a noted international tax expert, with...

The Impact of the Global Minimum Tax on Corporate Flows

Jack Brister Founder, International Wealth Tax Advisors Jack Brister, Founder of International Wealth Tax Advisors, is a noted international tax expert, with...

Redefining the 16th Amendment: The Impact of the Mandatory Repatriation Tax on Ultra High Net Worth Clients

Jack Brister Founder, International Wealth Tax Advisors Jack Brister, Founder of International Wealth Tax Advisors, is a noted international tax expert, with...

Stage three tax cuts: Albanese government must pass this integrity test

Gilti tax So let me be clear: as North Sydney’s representative, I remain of the position that stage three tax cuts should go ahead in 2024 as...

Joe Biden: Liz Truss tax cuts a ‘mistake’ and ‘I wasn’t the only one’ who thought so

Tax credits for international students Joe Biden has called Liz Truss’s abandoned UK tax cut plan a “mistake” and said he is worried that...

Manitoba needs to pick up the pace on tax relief

What is a foreign trust The province should look to its neighbours and other jurisdictions that are providing meaningful relief In the race to help people...

We're Here To Help!

Office

Hours

M-F: 9am – 5pm

S-S: Closed

Call Us

+1 (212) 256 – 1142